- Learn Crypto

- Posts

- 70% Fake? How Wash Trading Inflates Crypto Markets (and How to Spot It)

70% Fake? How Wash Trading Inflates Crypto Markets (and How to Spot It)

Unveiling the Illusion: Exposing the Tactics and Indicators of Wash Trading in Cryptocurrency Markets

Imagine you're scrolling through your favorite crypto exchange, excitement bubbling as you see Bitcoin surging towards a new all-time high. But before you hit that "buy" button, let's pump the brakes. A recent study by the National Bureau of Economic Research (NBER) found that wash trading – a deceptive practice that inflates trading volume – could be responsible for a staggering 70% of activity on unregulated exchanges. That's right, 7 out of every 10 trades you see might be a complete sham!

So, before you get caught in a wash trade web, let's dissect this shadowy practice and how it can impact your cryptocurrency investments.

Cryptocurrency's Dirty Little Secret: Wash Trading Exposed (with Data!)

Wash trading is a manipulative maneuver where someone buys and sells the same crypto asset within a short timeframe, often using multiple accounts. This creates artificial trading volume, making a coin seem more popular (and liquid) than it actually is. Data from Token Metrics, a crypto analysis firm, suggests that wash trading can inflate a coin's daily volume by a whopping 3000%. Imagine seeing a token with seemingly robust trading activity, only to discover it's a ghost town beneath the surface. Scary, right?

Why Do People Wash Trade Crypto? Buckle Up, It Gets Sneaky

There are a few reasons why someone might resort to wash trading, and none of them bode well for legitimate investors:

Pump and Dump Schemes: Deceptive individuals might use wash trading to inflate a coin's price artificially. Then, they dupe unsuspecting investors into buying the "hot" coin, only to dump their own holdings at a peak, leaving others holding the bag. A 2018 investigation by Bloomberg unearthed a scheme where a group used wash trading to manipulate the price of Bitcoin Gold, a derivative of Bitcoin. The price spiked by over 1,200% in a single day before crashing just as quickly, leaving many investors with significant losses.

Fake Popularity: New crypto exchanges might use wash trading to make themselves seem more active and attract real users. This can be particularly deceiving for beginners who might equate high trading volume with a trustworthy platform.

Gaming the System: Some investors use wash trades to exploit tax loopholes or manipulate rewards programs offered by certain exchanges. While this might seem like a clever trick, it's important to remember that wash trades are illegal in most jurisdictions, and getting caught can lead to hefty fines.

Case Study: DigiByte (DGB) - Wash Trading Allegations and Exchange Scrutiny

DigiByte (DGB), a self-proclaimed "faster Bitcoin" launched in 2014, faced accusations of wash trading on several cryptocurrency exchanges throughout 2019 and 2020. While the allegations weren't definitively proven, they raise important questions about exchange oversight and potential market manipulation.

Red Flags and Accusations:

Unusually High Volume on Smaller Exchanges: DigiByte's trading volume appeared disproportionately high on lesser-known exchanges compared to established platforms. This raised concerns as smaller exchanges might be more susceptible to manipulation.

Trading Pattern Analysis: On-chain analytics firms pointed towards suspicious trading patterns for DGB. These included frequent buy and sell orders at similar prices within short intervals, often originating from a limited number of wallets. This behavior aligns with classic wash trading tactics.

Impact on Market Price: Despite the high reported volume, DGB's price movements on major exchanges often remained subdued. This suggested the high volume on smaller exchanges might not reflect genuine buying pressure.

Exchange Reactions:

Scrutiny and Delistings: Several exchanges, including Bittrex and HitBTC, delisted DGB or flagged it for suspicious activity. This action aimed to protect users from potentially manipulated markets.

DigiByte's Response: The DigiByte project denied the wash trading allegations, claiming the high volume stemmed from organic growth in Asian markets.

Lingering Concerns:

While the situation didn't culminate in definitive proof of wash trading, it exposed potential vulnerabilities in the cryptocurrency market. The case highlights the importance of exchange vigilance and the challenges of identifying and deterring wash trading practices.

How to Avoid Becoming Wash Trading's Victim: Be a Crypto Sherlock Holmes

While completely eliminating wash trading is a work in progress for regulators, here are some tips to be a savvy crypto investor and avoid manipulated markets:

Look Beyond Volume: Don't be fooled by sky-high trading volume alone. Research the project, its team, and its actual use case. Solid projects with real-world applications are more likely to have sustainable growth than those propped up by wash trading.

Beware of Unrealistic Price Movements: If a coin's price shoots up inexplicably with minimal news or developments, it might be a sign of manipulation. Take Ethereum Classic (ETC) for example. In 2020, ETC's price spiked by over 700% in a single day, fueled by suspicions of wash trading activity. The price quickly retreated, leaving many investors with significant losses.

Check Exchange Reviews: See what other users say about an exchange's transparency and trading practices. Look for reputable exchanges with a history of fair trading and robust security measures.

Use Established Platforms: Stick to well-established exchanges with a proven track record. These platforms are more likely to have stricter measures in place to detect and prevent wash trading.

Remember, you're not just investing in a coin, you're investing in a community. Do your research, and don't let wash traders steal your crypto dreams!

Final Thoughts: Wash Trading Might Be Sneaky, But You Can Be Shrewder. Stay Informed and Happy Trading!

P.S. Confused about what crypto ...to buy? Don't worry, we've got you covered. Subscribe to the newsletter for in-depth analysis and unbiased insights on the hottest coins (the real kind, not the wash-traded kind). And hey, share this knowledge with your fellow crypto curious friends! The more informed investors we have, the stronger the crypto ecosystem becomes.

While we can't give specific financial advice, we can point you in the right direction to conduct your own research. Here are some resources to get you started:

CoinMarketCap (https://coinmarketcap.com/) and CoinGecko (https://www.coingecko.com/) - These platforms provide a wealth of information on cryptocurrencies, including market capitalization, trading volume (be mindful of wash trading!), historical price charts, and project details.

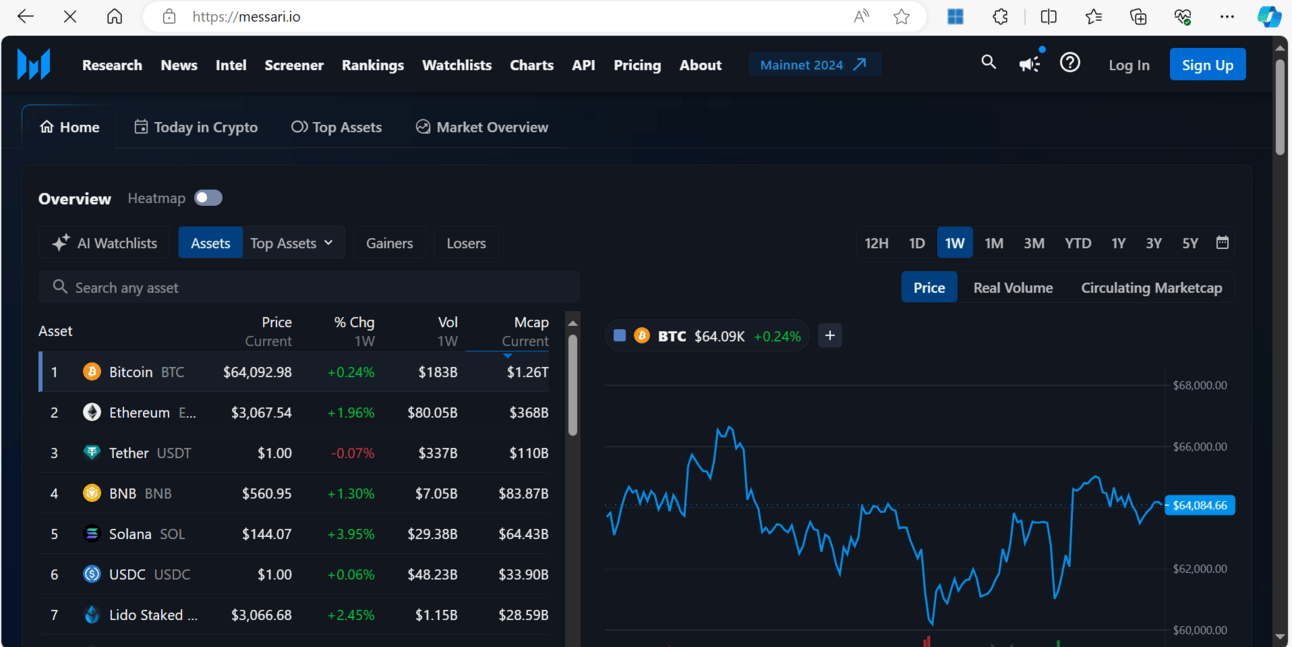

Messari (https://messari.io/) - This research firm offers in-depth reports on various blockchain projects, helping you understand the technology behind the coin.

This newsletter (of course!) - We'll be diving deeper into specific cryptocurrencies, exploring their potential applications and investment risks.

Remember, the crypto space is exciting and ever-evolving, but it's also important to be cautious. By educating yourself and avoiding wash trading pitfalls, you'll be well on your way to making informed investment decisions and navigating the exciting world of cryptocurrency.

Elevate your investment game with our FREE newsletter on Cryptocurrency for Investors - dive deep into market trends, uncover hidden gems, and secure your financial future. Subscribe now and embrace the excitement of crypto success!